|

#2

| |||

| |||

|

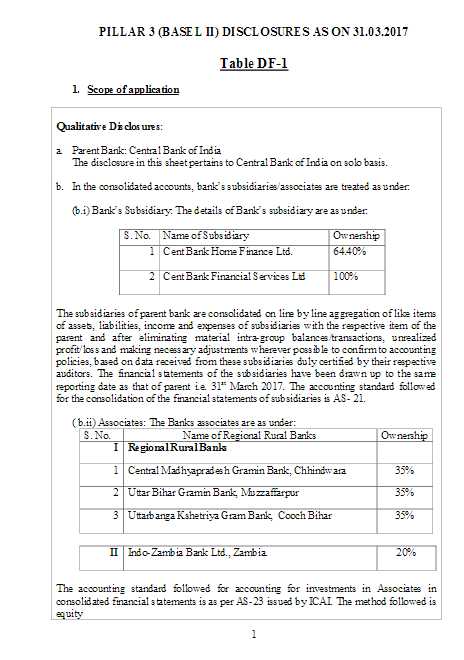

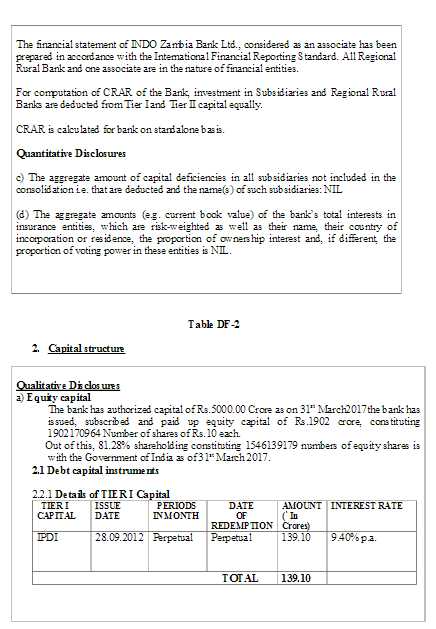

As you are looking for latest Basel II Disclosures of Central Bank of India, so here I am providing Basel II Disclosures: Latest Basel II Disclosures of Central Bank of India (As on 31.03.2017) SCOPE OF APPLICATION Qualitative Disclosures: a. Parent Bank: Central Bank of India The disclosure in this sheet pertains to Central Bank of India on solo basis. b. In the consolidated accounts, bank?s subsidiaries/associates are treated as under: (b.i) Bank?s Subsidiary: The details of Bank?s subsidiary are as under: Name of Subsidiary Ownership Cent Bank Home Finance Ltd. 64.40% Cent Bank Financial Services Ltd 100% The subsidiaries of parent bank are consolidated on line by line aggregation of like items of assets, liabilities, income and expenses of subsidiaries with the respective item of the parent and after eliminating material intra-group balances/transactions, unrealized profit/loss and making necessary adjustments wherever possible to confirm to accounting policies, based on data received from these subsidiaries duly certified by their respective auditors. The financial statements of the subsidiaries have been drawn up to the same reporting date as that of parent i.e. 31st March 2017. The accounting standard followed for the consolidation of the financial statements of subsidiaries is AS- 21. ( b.ii) Associates: The Banks associates are as under: Name of Regional Rural Banks Ownership Regional Rural Banks Central Madhyapradesh Gramin Bank, Chhindwara 35% Uttar Bihar Gramin Bank, Muzzaffarpur 35% Uttarbanga Kshetriya Gram Bank, Cooch Bihar 35% Indo-Zambia Bank Ltd., Zambia. 20% The accounting standard followed for accounting for investments in Associates in consolidated financial statements is as per AS-23 issued by ICAI. The method followed is equity The financial statement of INDO Zambia Bank Ltd., considered as an associate has been prepared in accordance with the International Financial Reporting Standard. All Regional Rural Bank and one associate are in the nature of financial entities. For computation of CRAR of the Bank, investment in Subsidiaries and Regional Rural Banks are deducted from Tier I and Tier II capital equally. CRAR is calculated for bank on standalone basis. Quantitative Disclosures c) The aggregate amount of capital deficiencies in all subsidiaries not included in the consolidation i.e. that are deducted and the name(s) of such subsidiaries: NIL (d) The aggregate amounts (e.g. current book value) of the bank?s total interests in insurance entities, which are risk-weighted as well as their name, their country of incorporation or residence, the proportion of ownership interest and, if different, the proportion of voting power in these entities is NIL. Latest Basel II Disclosures of Central Bank of India   |

|

Similar Threads

Similar Threads | ||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Uttar Bihar Gramin Bank Central Bank Of India | Unregistered | Main Forum | 1 | 2nd February 2018 12:14 PM |

| RSETI Central Bank Of India | Unregistered | Main Forum | 1 | 23rd December 2016 11:16 AM |

| Central Bank Of India Trichy | Unregistered | Main Forum | 1 | 23rd November 2016 02:42 PM |

| Central Bank Of India Gyanpur | Unregistered | Main Forum | 1 | 3rd November 2016 11:41 AM |

| Central Bank Of India Jeeran | Unregistered | Main Forum | 1 | 2nd November 2016 01:40 PM |

| Central Bank Of India SWO | Unregistered | Main Forum | 1 | 22nd October 2016 05:21 PM |

| Central Bank Of India CWE | Unregistered | Main Forum | 1 | 19th October 2016 02:45 PM |

| Central Bank of India RTI | Unregistered | Main Forum | 1 | 17th October 2016 09:47 AM |

| Central Bank Of India Login Id | Unregistered | Main Forum | 1 | 15th October 2016 06:28 PM |

| Central Bank Of India In GK | Unregistered | Main Forum | 1 | 15th October 2016 12:09 PM |

| Central Bank Of India ED | Unregistered | Main Forum | 1 | 7th October 2016 05:06 PM |

| Central Bank of India LFC | Unregistered | Main Forum | 1 | 6th October 2016 04:01 PM |

| Central Bank of India CMD | Unregistered | Main Forum | 1 | 6th October 2016 11:19 AM |

| Central Bank of India Siwan | Unregistered | Main Forum | 1 | 4th October 2016 12:21 PM |

| Central Bank of India CBE Branches | Unregistered | Main Forum | 1 | 29th September 2016 05:22 PM |

| Central Bank of India | Unregistered | Main Forum | 1 | 14th November 2015 04:31 PM |

| Central bank of India Recruitment MP | Unregistered | Main Forum | 0 | 18th July 2015 09:57 AM |

| Central bank of India ATM in gurgaon | margareth3 | Main Forum | 1 | 29th January 2013 02:24 PM |

| Central Bank of India Surat ATM | Unregistered | Main Forum | 1 | 13th December 2012 03:18 PM |

| Central Bank of India in Udaipur | ramadevin .. | Main Forum | 1 | 8th October 2012 01:36 PM |

| |