|

#2

| |||

| |||

|

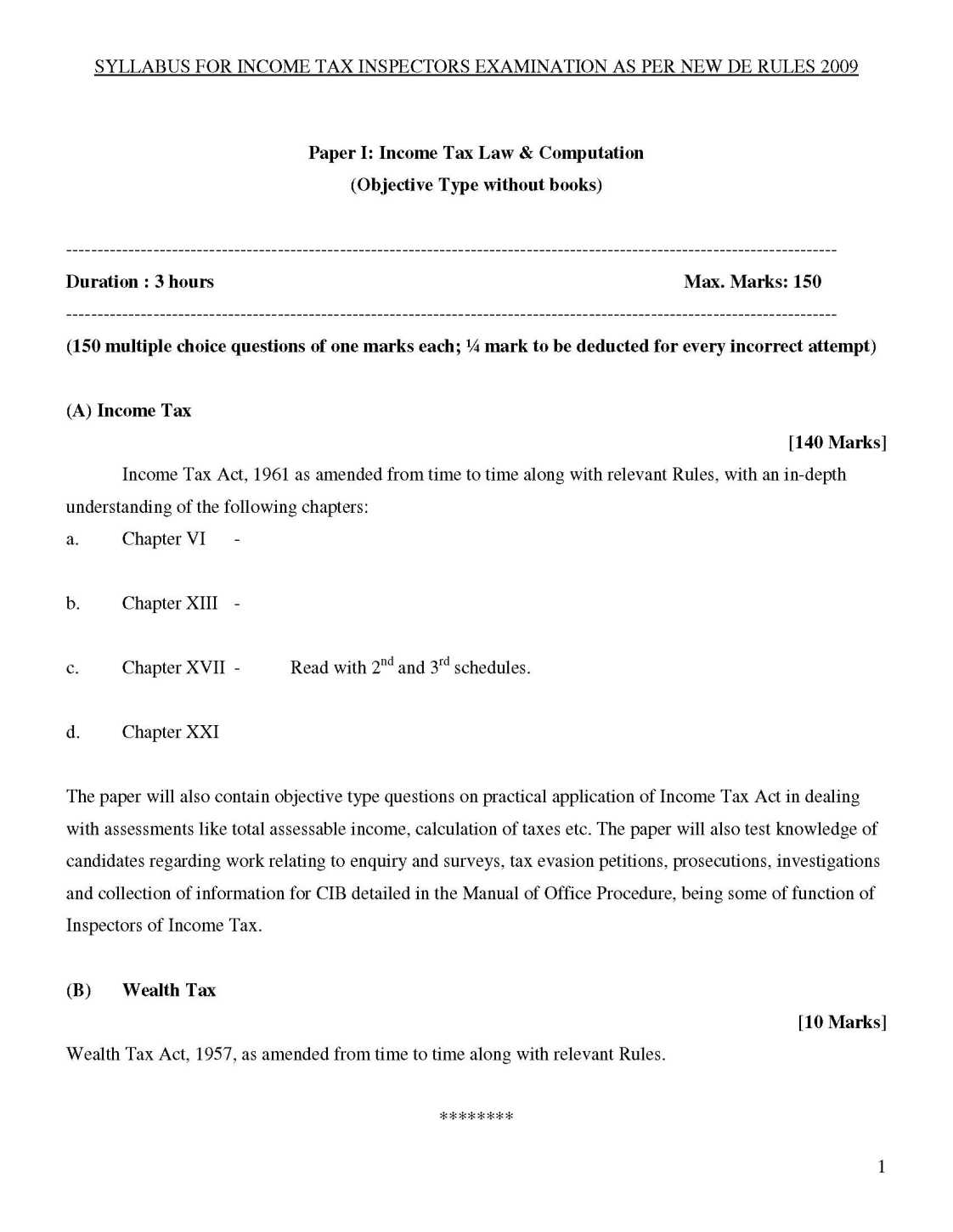

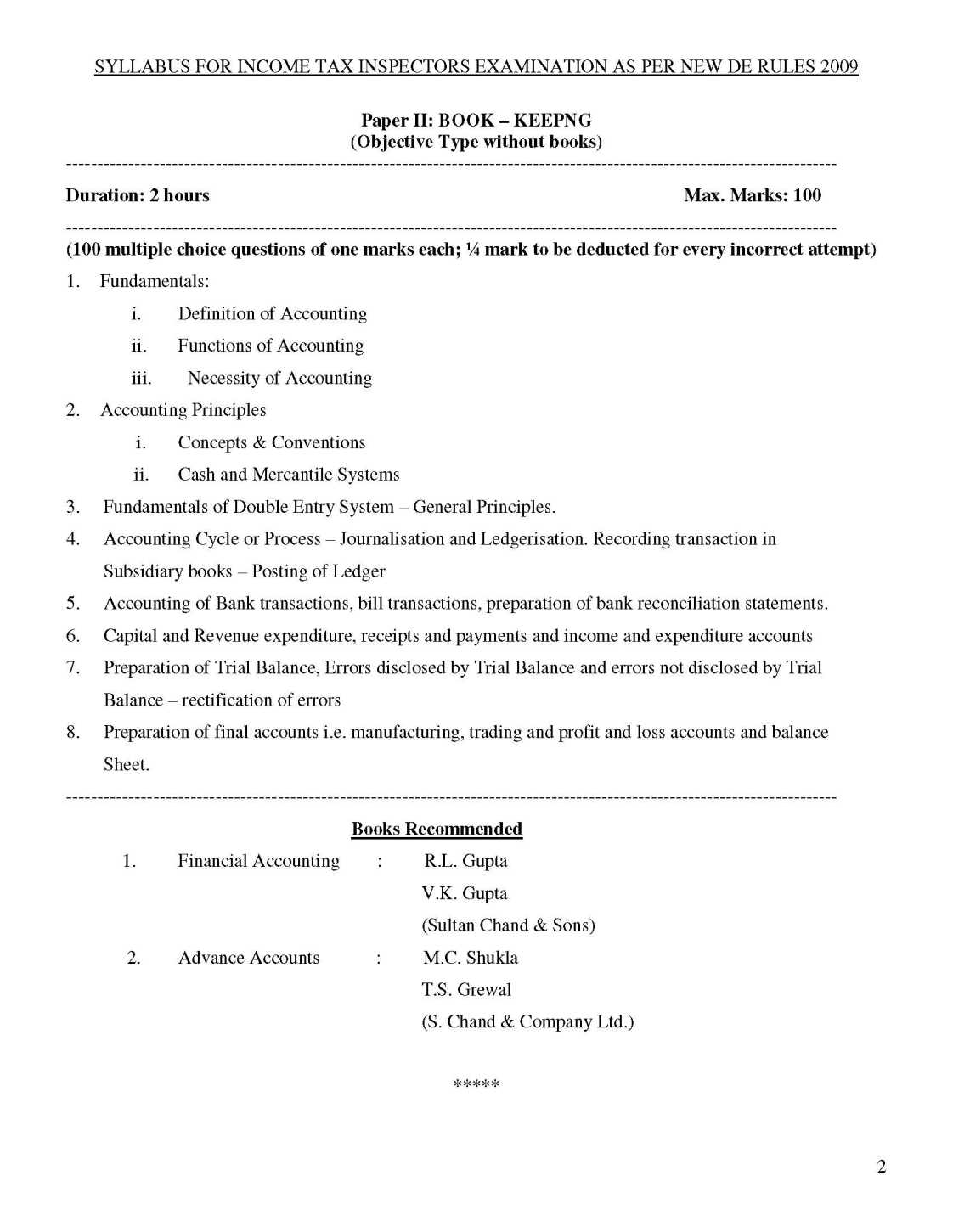

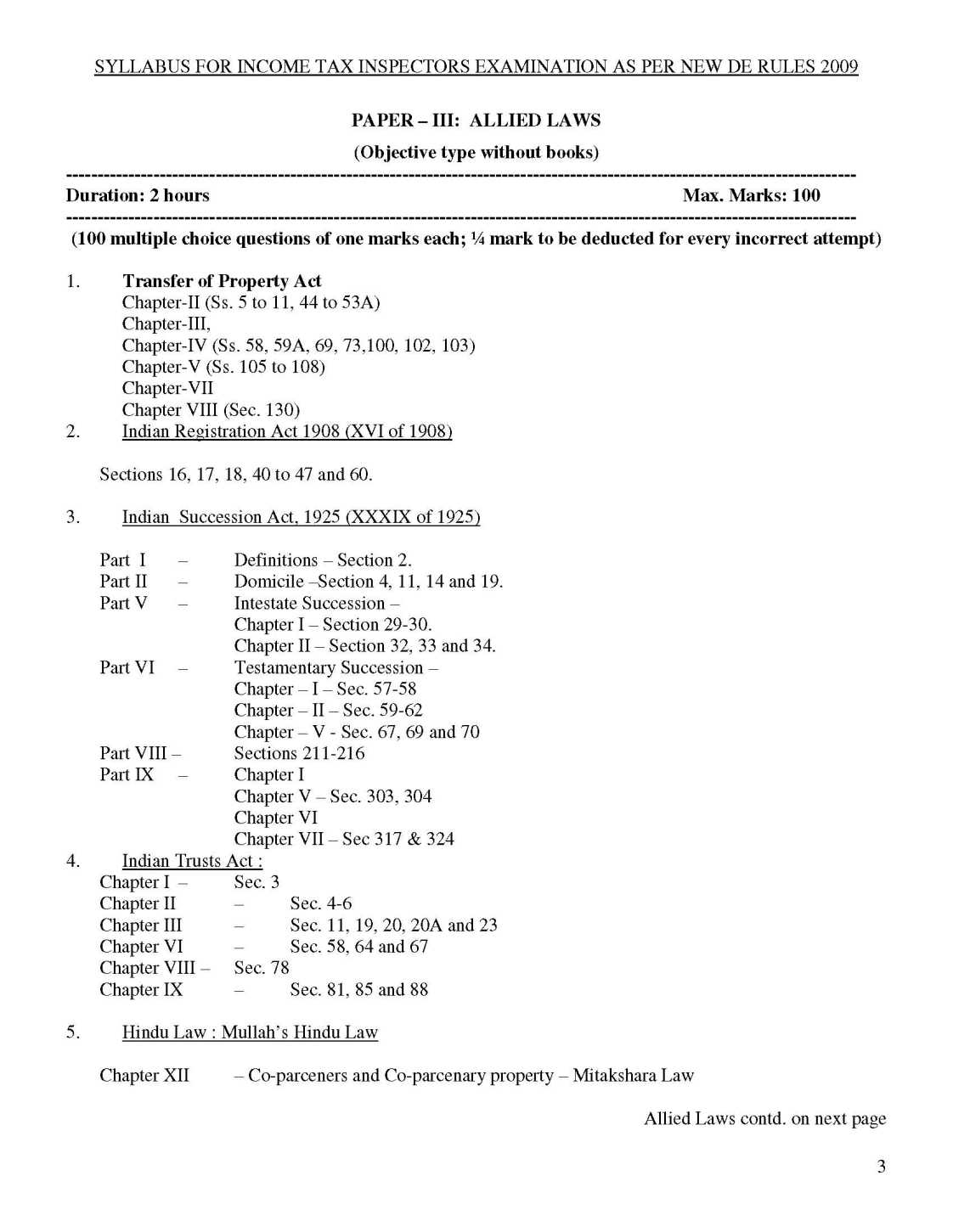

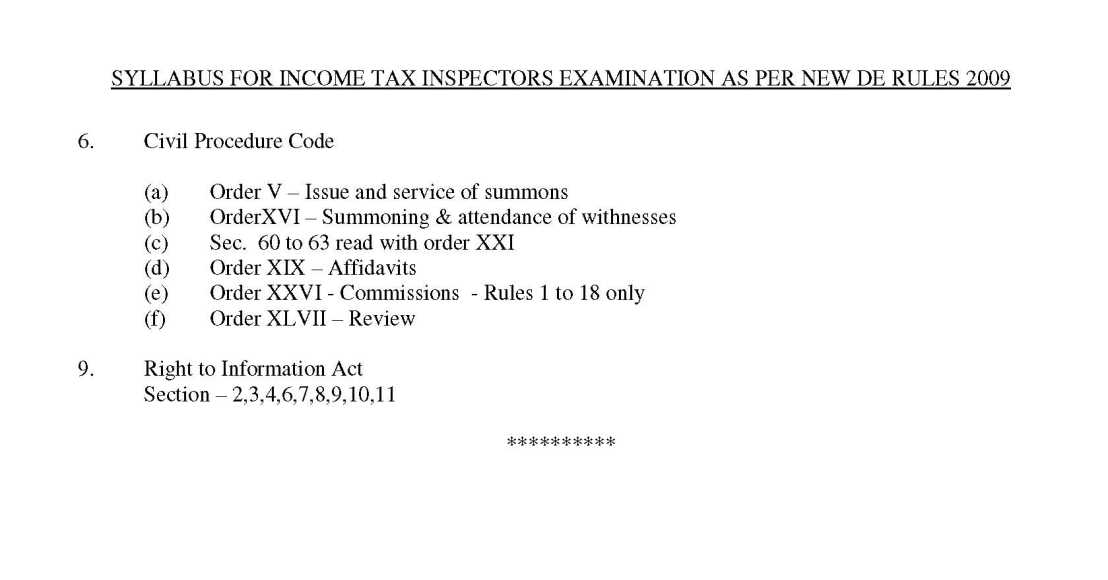

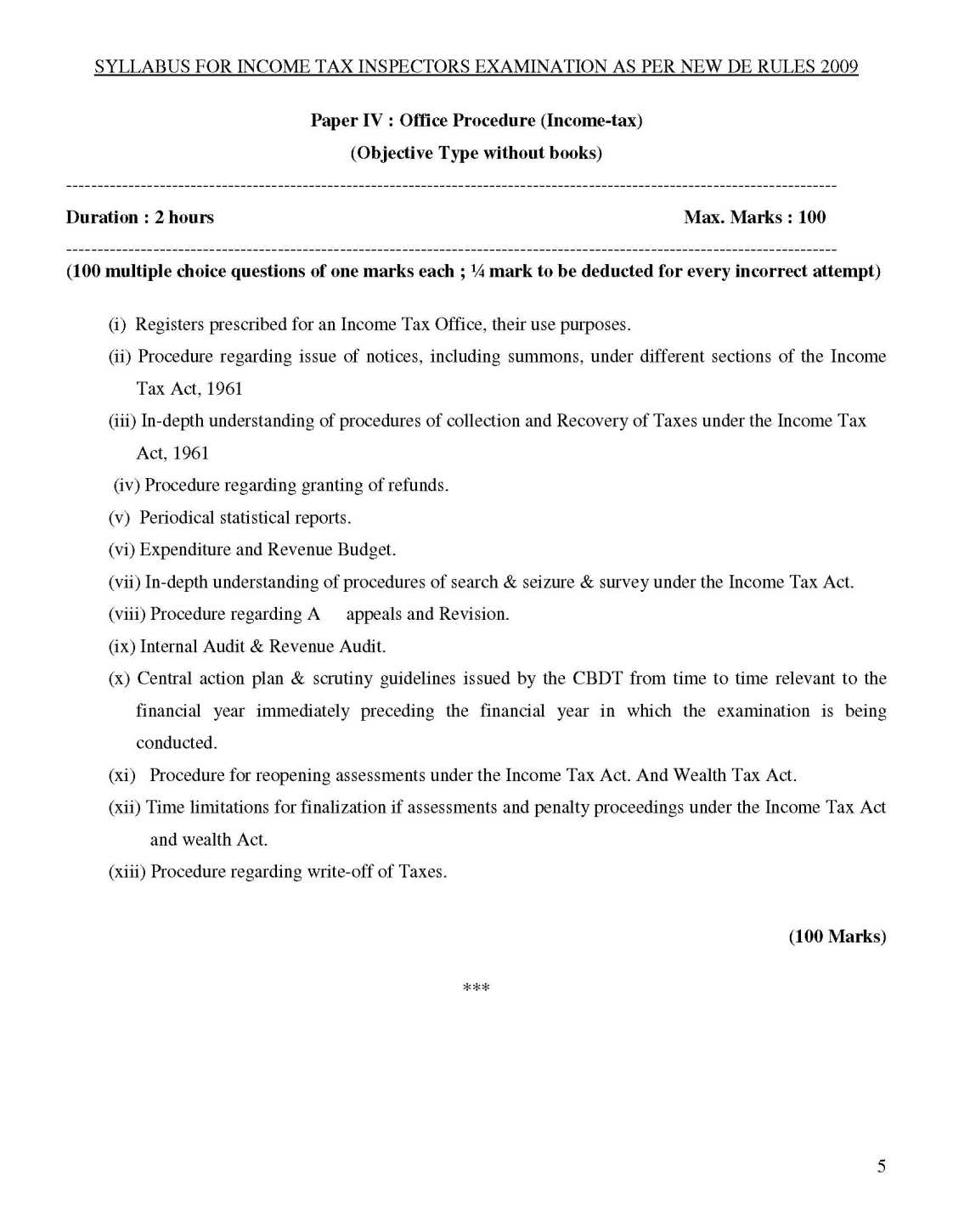

As per your request here I am giving you syllabus for Income Tax Law & Computation paper for Income Tax Inspector recruitment exam. Syllabus for Income Tax Law & Computation paper: (A) Income Tax Income Tax Act, 1961 as amended from time to time along with relevant Rules, with an in-depth understanding of the following chapters: a. Chapter VI - b. Chapter XIII - c. Chapter XVII - Read with 2nd and 3rd schedules. d. Chapter XXI The paper will also contain objective type questions on practical application of Income Tax Act in dealing with assessments like total assessable income, calculation of taxes etc. The paper will also test knowledge of candidates regarding work relating to enquiry and surveys, tax evasion petitions, prosecutions, investigations and collection of information for CIB detailed in the Manual of Office Procedure, being some of function of Inspectors of Income Tax. (B) Wealth Tax Wealth Tax Act, 1957, as amended from time to time along with relevant Rules. Paper II: BOOK – KEEPNG 1. Fundamentals: i. Definition of Accounting ii. Functions of Accounting iii. Necessity of Accounting 2. Accounting Principles i. Concepts & Conventions ii. Cash and Mercantile Systems 3. Fundamentals of Double Entry System – General Principles. 4. Accounting Cycle or Process – Journalisation and Ledgerisation. Recording transaction in Subsidiary books – Posting of Ledger 5. Accounting of Bank transactions, bill transactions, preparation of bank reconciliation statements. Income Tax Inspector recruitment exam Syllabus       |

|

Similar Threads

Similar Threads | ||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Notes for MBA Entrance Exam | rachit bhargava.x | Main Forum | 2 | 23rd February 2018 03:43 PM |

| Income Tax Officer Exam In Gujarat | Unregistered | Main Forum | 1 | 22nd December 2016 12:52 PM |

| RBI Exam Notes | Unregistered | Main Forum | 1 | 12th November 2016 11:33 AM |

| Income Tax Recruitment Exam | Unregistered | Main Forum | 1 | 10th November 2016 05:53 PM |

| H&R Block Income Tax Course Final Exam | Unregistered | Main Forum | 1 | 10th November 2016 05:00 PM |

| Income Tax Officer Next Exam | Unregistered | Main Forum | 1 | 7th November 2016 04:28 PM |

| SSC Income Tax Inspector Exam Papers | Unregistered | Main Forum | 1 | 27th October 2016 02:48 PM |

| Income Tax Officer Exam Criteria | Unregistered | Main Forum | 1 | 27th October 2016 01:34 PM |

| Income Tax Officer Exam By SSC | Unregistered | Main Forum | 1 | 24th October 2016 06:02 PM |

| SSC Income Tax Officer Exam Date | Unregistered | Main Forum | 1 | 21st October 2016 10:29 AM |

| SSC Income Tax Exam Admit Card | Unregistered | Main Forum | 1 | 20th October 2016 04:07 PM |

| How To Study For Income Tax Exam | Unregistered | Main Forum | 1 | 14th October 2016 01:07 PM |

| Income Tax Officer Exam Pattern | Unregistered | Main Forum | 1 | 13th October 2016 02:46 PM |

| Income Tax Officer Upcoming Exam | Unregistered | Main Forum | 1 | 10th October 2016 04:52 PM |

| IB ESS Exam Notes | Unregistered | Main Forum | 1 | 10th October 2016 02:57 PM |

| SSC Income Tax Officer Exam Admit Card | Unregistered | Main Forum | 1 | 4th October 2016 01:06 PM |

| Income Tax And Excise Exam | Unregistered | Main Forum | 1 | 3rd October 2016 09:48 AM |

| RPF Exam Notes | Unregistered | Main Forum | 1 | 28th September 2016 09:09 AM |

| Income tax officer exam paper IV question bank | Unregistered | Online MBA Discussions | 1 | 19th November 2015 04:44 PM |

| Can I apply for Income Tax officer exam after diploma in Pharmacy, B.Pharm. and MBA | Unregistered | Main Forum | 1 | 4th November 2015 05:39 PM |

| |