| 20th November 2015 11:32 AM | |

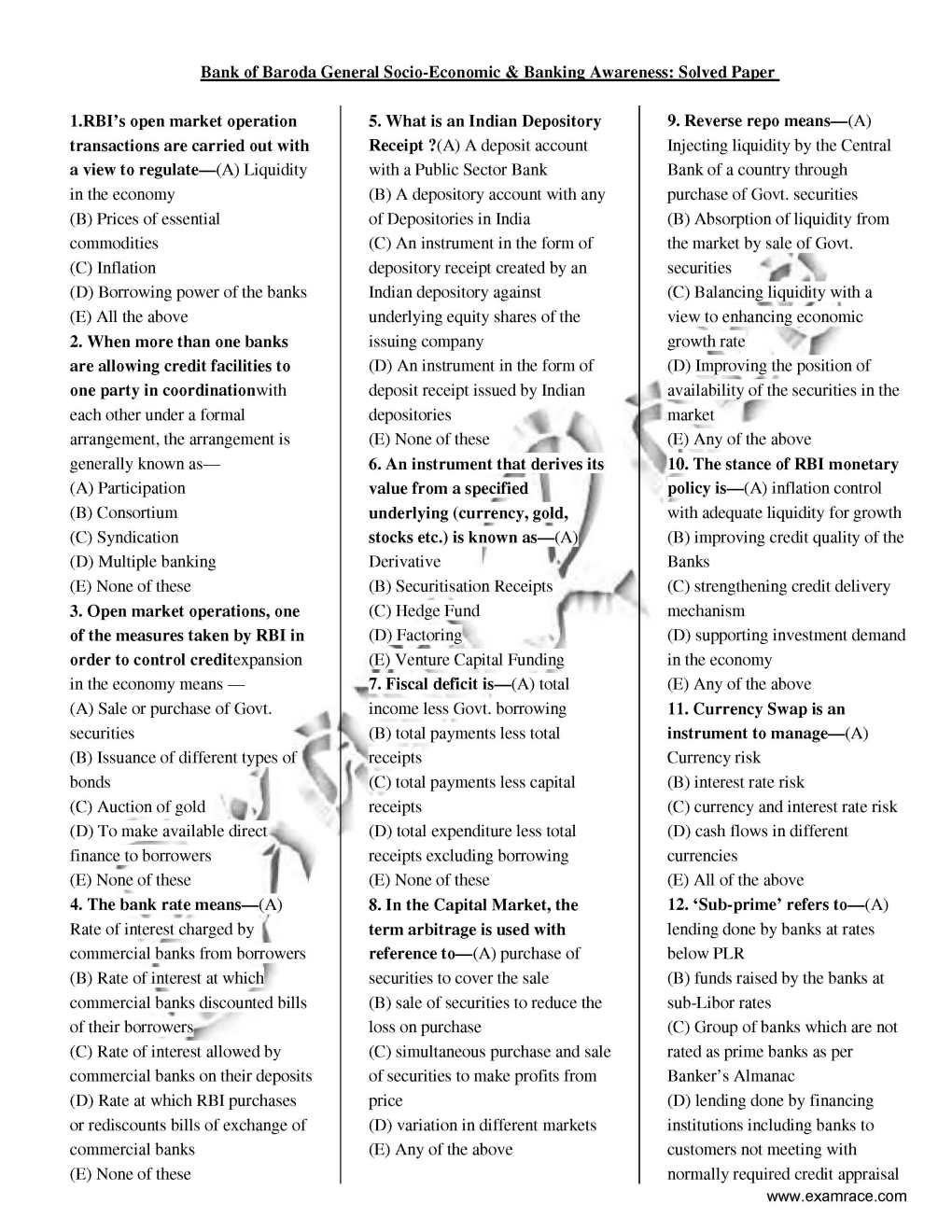

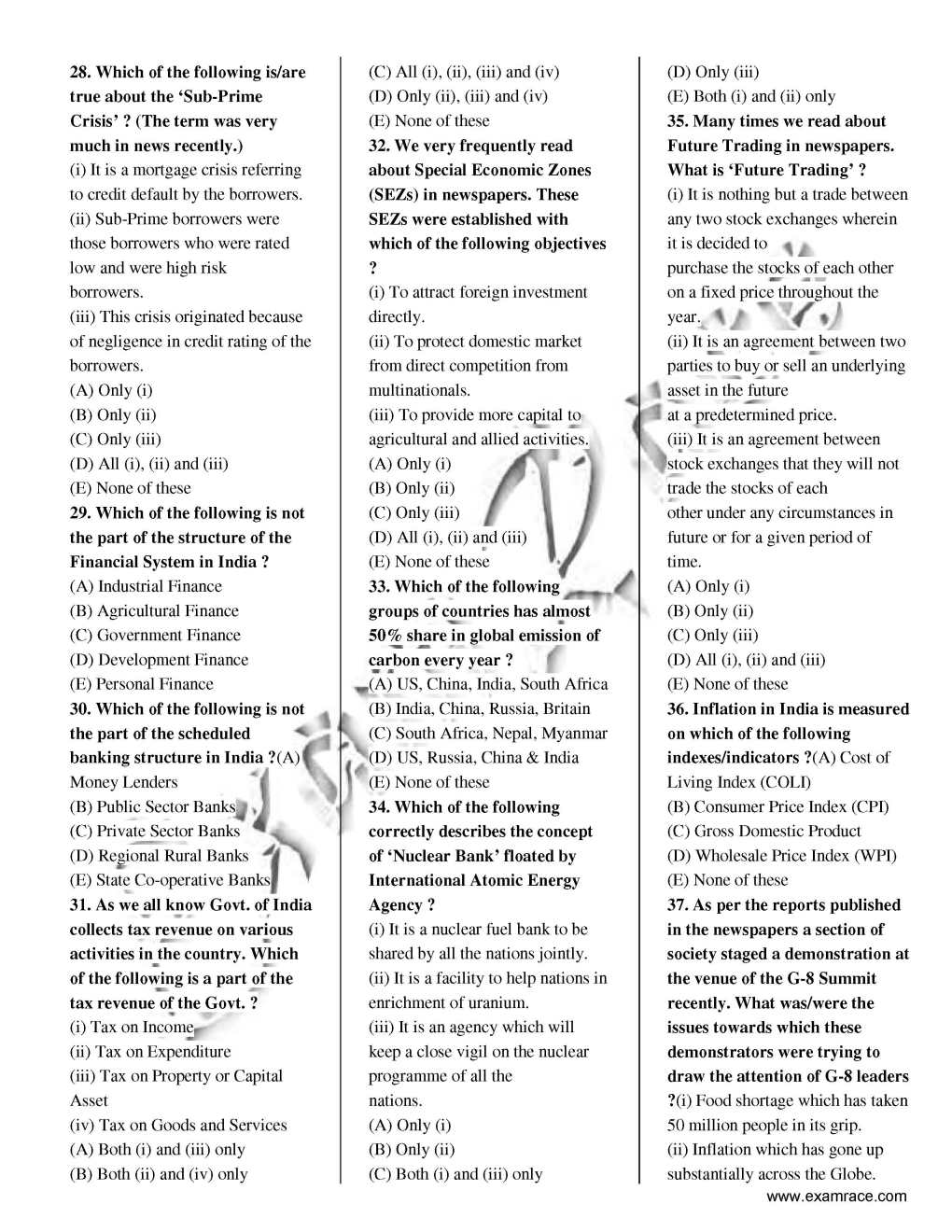

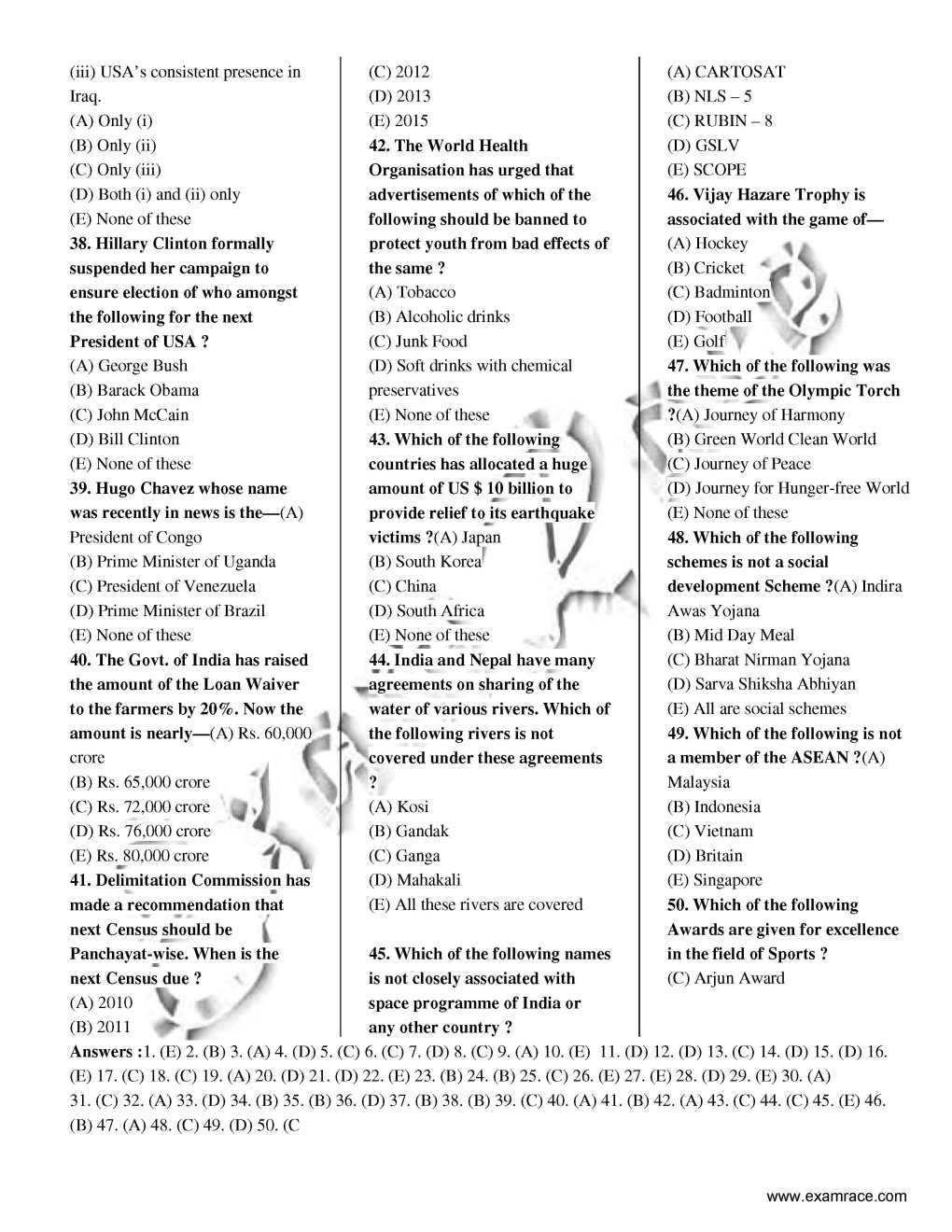

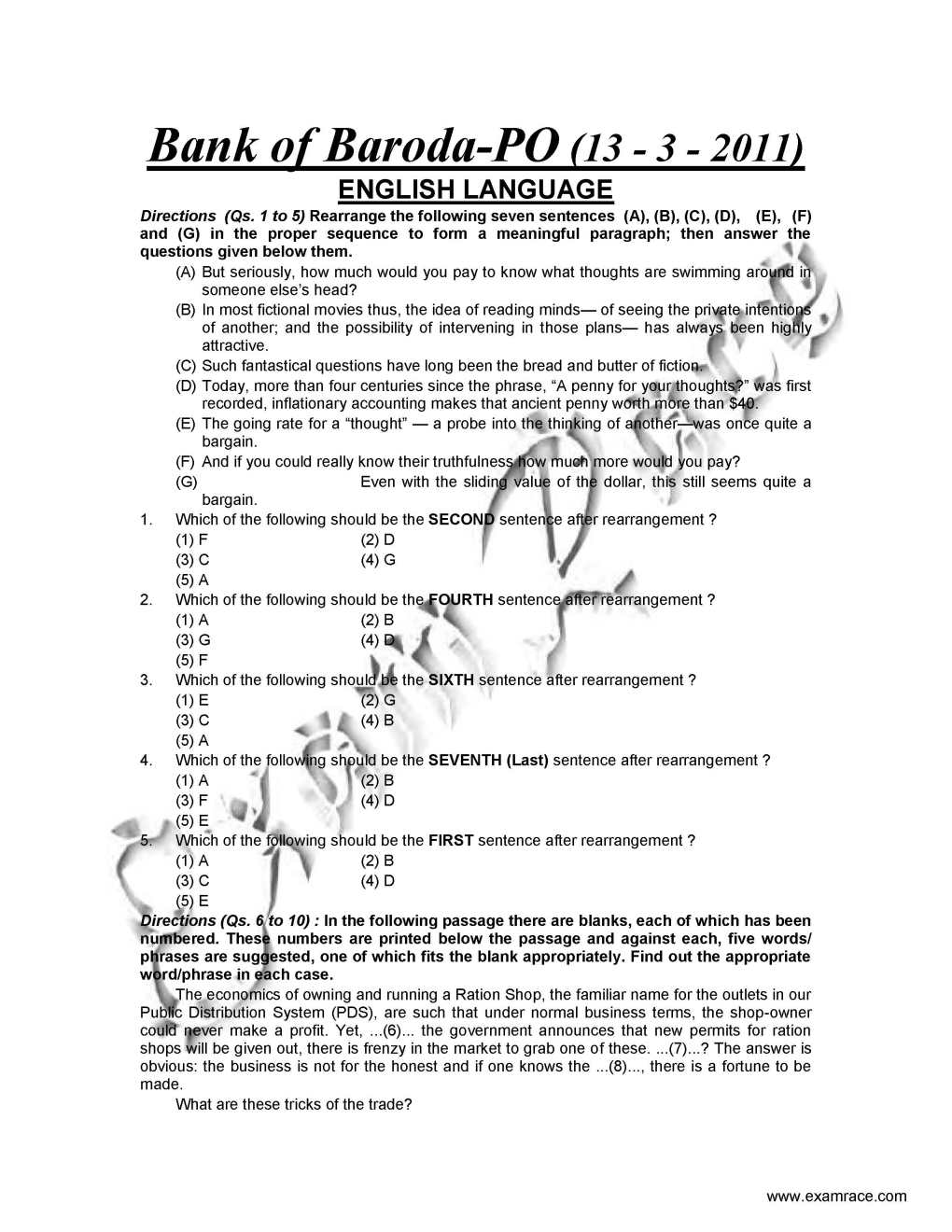

| Saksham | Re: Bank Of Baroda Socio-Economic Banking Awareness Papers As you asking for the previous year question paper of the Bank of baroda PO examination of the Socio-Economic Banking Awareness the question paper is given below : 1.RBI’s open market operation transactions are carried out with a view to regulate—( A) Liquidity in the economy (B) Prices of essential commodities (C) Inflation (D) Borrowing power of the banks (E) All the above 2. When more than one banks are allowing credit facilities to one party in coordinationwith each other under a formal arrangement, the arrangement is generally known as— (A) Participation (B) Consortium (C) Syndicatio 5. What is an Indian Depository Receipt ?(A) A deposit account with a Public Sector Bank (B) A depository account with any of Depositories in India (C) An instrument in the form of depository receipt created by an Indian depository against underlying equity shares of the issuing company (D) An instrument in the form of deposit receipt issued by Indian depositories (E) None of these 6. An instrument that derives its value from a specified underlying (currency, gold, stocks etc.) is known as—(A) Derivative (B) Securitisation Receipts (C) Hedge Fund (D) Factoring (E) Venture Capital Funding 7. Fiscal deficit is—(A) total income less Govt. borrowing (B) total payments less total receipts (C) total payments less capital receipts (D) total expenditure less total receipts excluding borrowing (E) None of these 8. In the Capital Market, the term arbitrage is used with reference to—(A) purchase of securities to cover the sale (B) sale of securities to reduce the loss on purchase (C) simultaneous purchase and sale of securities to make profits from price (D) variation in different markets (E) Any of the above 9. Reverse repo means—(A) Injecting liquidity by the Central Bank of a country through purchase of Govt. securities (B) Absorption of liquidity from the market by sale of Govt. securities (C) Balancing liquidity with a view to enhancing economic growth rate (D) Improving the position of availability of the securities in the market (E) Any of the above 10. The stance of RBI monetary policy is—(A) inflation control with adequate liquidity for growth (B) improving credit quality of the Banks (C) strengthening credit delivery mechanism (D) supporting investment demand in the economy (E) Any of the above 11. Currency Swap is an instrument to manage—(A) Currency risk (B) interest rate risk (C) currency and interest rate risk (D) cash flows in different currencies (E) All of the above Rest of the questions you may find in the file given below : Bank of baroda Socio-Economic Banking Awareness Papers      |

| 20th November 2015 09:55 AM | |

| Unregistered | Bank Of Baroda Socio-Economic Banking Awareness Papers Hii sir, I wanted to get the previous year question paper of the bank of Baroda socio – economics banking Awareness? Please provide it ? |